Starting a business in Cape Verde represents a promising opportunity for entrepreneurs who want to explore emerging markets and capitalise on the region's economic growth.

With this complete guide S&D Consulting aims to provide detailed and up-to-date information on the process of setting up a business in this African archipelago, known for its political stability and incentives for foreign investment.

Contents

Cape Verde offers an increasingly favourable business environment, with incentives for entrepreneurship, simplified processes and legal stability. Whether you're launching a micro-enterprise or structuring a medium-sized business, being well-informed is the first step to success.

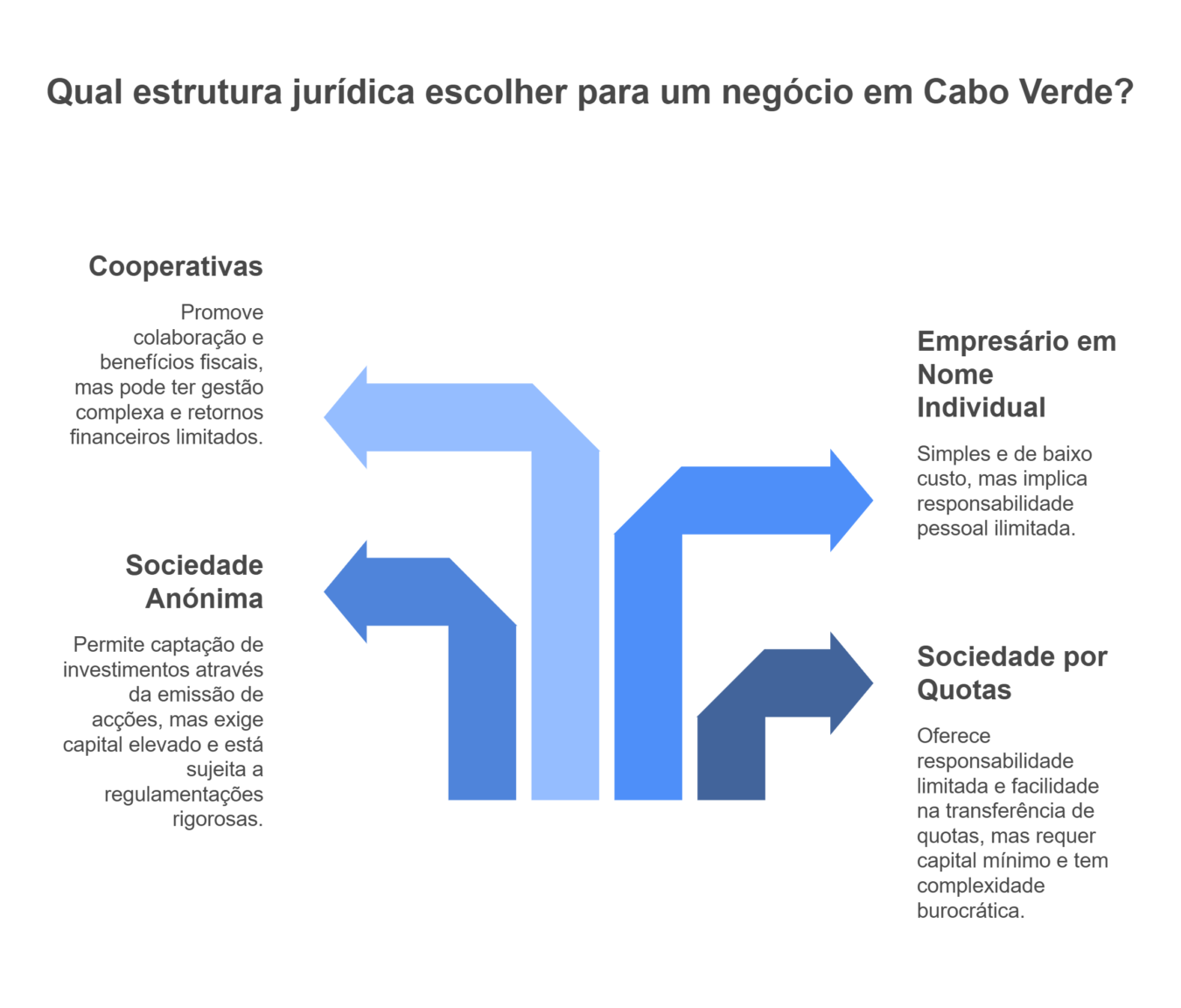

The choice of legal structure is a crucial step when opening a company in Cape Verde, as it determines the legal, fiscal and operational aspects of the business.

We detail the main legal structures available, their characteristics, advantages and disadvantages, as well as practical considerations for entrepreneurs:

The Private Limited Company is one of the most common forms of business structure in Cape Verde. It is characterised by the limited liability of the partners, which is restricted to the amount of their quotas.

The public limited company is suitable for larger companies wishing to raise funds on the capital markets.

This structure is ideal for small businesses or individual entrepreneurs, where there is no separation between personal and business assets.

Cooperatives are organisations formed by a group of people with common interests, especially in sectors such as agriculture and fishing.

Setting up a company in Cape Verde is an accessible process, but one that requires attention to legal and administrative details. To ensure that everything runs efficiently and without complications, it is essential to follow a set of fundamental steps that guarantee the formalisation of the business and its operation within the law.

The first step is to define the type of company most suited to the entrepreneur's profile and objectives. In Cape Verde, it is possible to choose between different legal forms: the Sole proprietorideal for self-employed activities; the Private Limited Company, suitable for those who want to operate alone but with limited liability; the Private limited companiesthe most common form in small and medium-sized companies; and the Public Limited Company (SA), recommended for larger corporate structures and capital.

After choosing the type of company, proceed to trade name reservation. This process can be carried out online, through the Casa do Cidadão Portal, or in person at a Commercial Registry Office. Approval of the name guarantees exclusivity and avoids legal conflicts with other organisations.

The next step is drawing up the social pactThis is an essential document that formalises the incorporation of the company. It must contain the shareholder details, share capital, business purpose, registered office and operating rules. This document serves as the basis for the official registration of the company.

Next, the company registration at the Registry Office. With this act, the company acquires legal personality and the Tax Identification Number (TIN)This is essential for all future tax and legal operations.

Once you've finished registering, you need to submit the declaration of commencement of activity at the tax office. This declaration includes the choice of tax regime, identification of the company's economic activity (CAE) and the initial financial forecasts. Without this step, the company will not be able to operate legally.

Finally, it is essential to check that the activity to be carried out requires specific licensing. Sectors such as commerce, tourism, catering, construction, health and education are subject to licences which must be obtained from local councils or the ministries responsible. These documents are essential for the legal exercise of the activity and avoid future penalties.

Before starting or expanding your business in Cape Verde, it is essential to know the main legal instruments that regulate business activity in the country. These provide a framework for the operation of companies, the types of company allowed and the tax benefits available to entrepreneurs.

O Commercial Companies Code is the legal basis for all forms of economic activity in Cape Verde, from a private law perspective. This instrument regulates the various legal forms that a company can take, ensuring a clear and transparent framework for those wishing to undertake or invest in the country.

See the Commercial Companies Code:

Cape Verde's tax system includes various tax benefits designed to promote private investment, job creation and sustainable economic development. These incentives are provided for in the respective Tax Benefits Codeand complementary legislation.

The main benefits include:

These incentives apply to both domestic and foreign investment projects, provided they fulfil the criteria defined by Cape Verde's tax and economic authorities.

See Tax Benefits Code to find out more about the advantages applicable to your sector of activity.

If you want to start a business in Cape Verde, formally registering your company is a mandatory step. The country offers the Company On The Day (END)is a service designed to simplify the incorporation of commercial companies, allowing the process to be completed in just 24 hours - ideal for situations that do not require special authorisations or share capital in kind.

The NDT regime applies to private limited companies, single-member private limited companies, public limited companies and single-member public limited companies, as appropriate. Decree-Law no. 9/2008 of 13 March. However, in more complex cases - or when the NDT service is limited, as was the case during the pandemic - it may be necessary to resort to the traditional method, by registering at the Registry Office, a process that may take a few extra days.

To formalise a company in Cape Verde, you need to gather a series of documents, the requirements of which vary depending on the profile of the partners - whether they are natural persons, legal entities or even minors. Applicants must submit their Tax Identification Number (TIN)as well as the Identity Card, National Identification Card or Passport. If you are not a partner or shareholder of the company, you must also submit a recognised power of attorney.

If the partners or shareholders are natural persons, each one must also submit the NIF and a valid identity document. For collective members, the following are required minutes of the decision to participate in the company and commercial registration certificate of the organisation. If any member is a minor, a copy of their name is required. declaration signed by parents or legal representativewith a recognised signature, expressing consent to the minor's participation in the company, accompanied by the personal identity card, birth certificate or ID of the minoras well as its NIF.

In terms of costs, starting a business in Cape Verde implies, on average, an initial investment of 600$00 for the certificate of admissibility of the name, 10.000$00 by the formal creation of the company and, optionally, 1.000$00 for registration with CCISS (Leeward Chamber of Commerce, Industry and Services) or CCB/AE (Windward Chamber of Commerce/Business Association). These figures may change, so it is always advisable to check with the relevant authorities before starting the process.

If you created your company through the special regime Company On The Day (END)However, you should be aware that it is possible to make various structural changes to your legal entity, as provided for in the Decree-Law no. 11/2014, of 21 February. These changes can be made in person at the Citizen's Centreand cover different aspects of corporate life.

Possible changes include change of name (company name), transfer of shares, share capital increase, change of corporate object, change of headquarters and appointment or replacement of governing bodies.

The following documents must be presented for any change: valid identity card or passport of the legal representative, minutes of the amendment approved by the shareholders, the company's up-to-date commercial registration certificate, e document proving the legitimacy of the applicantif he is not a partner or shareholder.

Depending on the type of change, additional documents may be required:

Once the documents have been submitted, the changes are processed within an average time of 48 hoursfor a fee of 10.000$00 CVE (value subject to updating).

Closing down a company in Cape Verde is now a relatively simple process, thanks to the Special Regime for the Closure and Extinction of Commercial Companiesregulated by the Decree-Law no. 22/2022, of 4th April. Closure can be requested by shareholders, legal representatives or members of the governing bodies, simply by contacting a branch of the Citizen's Centre.

The application for winding up can be made at any time, provided that the company does not present outstanding assets or liabilities. Submission of the correct documentation ensures that the process is completed within a period of 48 hoursfor a fee of 10.000$00 CVE (value subject to updating).

The documents required vary depending on who submits the application:

If the request is submitted by a partner:

If presented by a legal representative:

If all members are present:

This procedure aims to reduce bureaucracy in the process of winding up companies and make it easier to formalise the cessation of activity quickly and legally.

See the Company Registration Code :

In order to operate legally in Cape Verde, companies must ensure that they have all the necessary licences and authorisations required by lawDepending on the sector of activity. From commerce to industry, construction to technology, each area requires specific procedures to guarantee legal compliance and the sustainability of operations.

In the Cape Verdean context, the commercial licences are compulsory for any company wishing to engage in economic activity. However, companies linked to manufacturing and industrial production need specific industrial licencesissued by Ministry of Industry, Trade and Energy.

This process may involve:

Approval is subject to verification of compliance with technical and environmental standards, ensuring that operations do not harm the environment.

Companies wishing to build their own facilities or operate in the construction sector must obtain the appropriate town planning licencesissued by town halls. This type of licence requires:

In denser urban areas, the requirements tend to be more stringent, making proper technical planning essential.

Companies in the food, pharmaceutical, hospital and other sectors with a direct impact on public health must obtain licences issued by the Ministry of Health. These requirements guarantee the safety of the products and services provided, including:

To do business in international trade, it is compulsory to obtain a export and import licencesmanaged by General Directorate of Customs. The process includes:

These procedures are designed to guarantee the legality and security of trade with foreign countries.

With the growth of the technology sector in Cape Verde, companies operating in this segment must obtain specific authorisations, particularly from the communications regulatory authorities. These licences may cover:

Obtaining licences and authorisations in Cape Verde is a fundamental and often complex process. It requires in-depth knowledge of the applicable legislation and adequate technical preparation to fulfil all the legal requirements. In S&D Consultancywe provide complete and personalised support throughout the business licensing process, ensuring that your business is legalised, secure and ready to operate with confidence.

Opening a company in Cape Verde in 2024 requires more than simply filling in forms - it's a strategic decision that starts with the the right choice of legal structurewith a direct impact on legal, fiscal and operational business. Among the options available, such as Private limited companies, Public limited company, Sole proprietor e Co-operativesEach one has advantages and challenges that must be carefully evaluated in the light of the long-term objectives and growth strategy of the company.

The constitution process involves crucial stages such as the registration at the Commercial Registry Office, a obtaining a Tax Identification Number (TIN) and Social Security (INPS) enrolment. In addition, many activities require specific licencesThese include commercial, environmental, health and technological issues, the complexity of which can vary depending on the sector and geographical location.

In this context, it is highly recommended to rely on the support of qualified professionals. A S&D Consultancy offers a complete business consultancy e managementensuring that each stage of the process runs smoothly, efficiently and safely. With a good financial planningknowledge of current legal framework and specialised support, the first step has been taken towards a solid, competitive business that is ready to grow in the Cape Verdean market.

International Business Centre

Cape Verde