Business licensing in Cape Verde is a fundamental process for formalising and legalising businesses in the archipelago. This procedure ensures that companies operate within the established legal framework, promoting a formal economic environment that complies with local laws. Licensing not only protects public health and safety, but also guarantees the protection of consumer interests and maintains fair competition in the market.

In Cape Verde, the business licensing process may seem complex, but it is manageable with the right approach and resources. The Cape Verdean government provides several online resources which are valuable for entrepreneurs, such as the website of the Ministry of Industry, Commerce and Energy (MICE), which offers guidelines on licences and permits required for various sectors. In addition Cape Verde Tax Authority can help clarify tax obligations related to business operations and licensing.

The first step in setting up a business in Cape Verde is to register with the appropriate government authorities, typically the Commercial Registry. This process is crucial, as it formalises the existence of the business entity within the country's legal framework. In order to register, entrepreneurs must gather a series of necessary documents, including valid identification documents, proof of residence and, if applicable, previous business registration documents. In addition, a detailed business plan describing the nature of the business, the anticipated operational framework and financial projections is often required.

Companies intending to operate in regulated sectors such as finance, tourism or health can expect additional requirements, including licences from relevant regulatory agencies. This licensing process is essential not only for legal compliance, but also for strategic positioning in the market, contributing to Cape Verde's wider economic development.

Contents

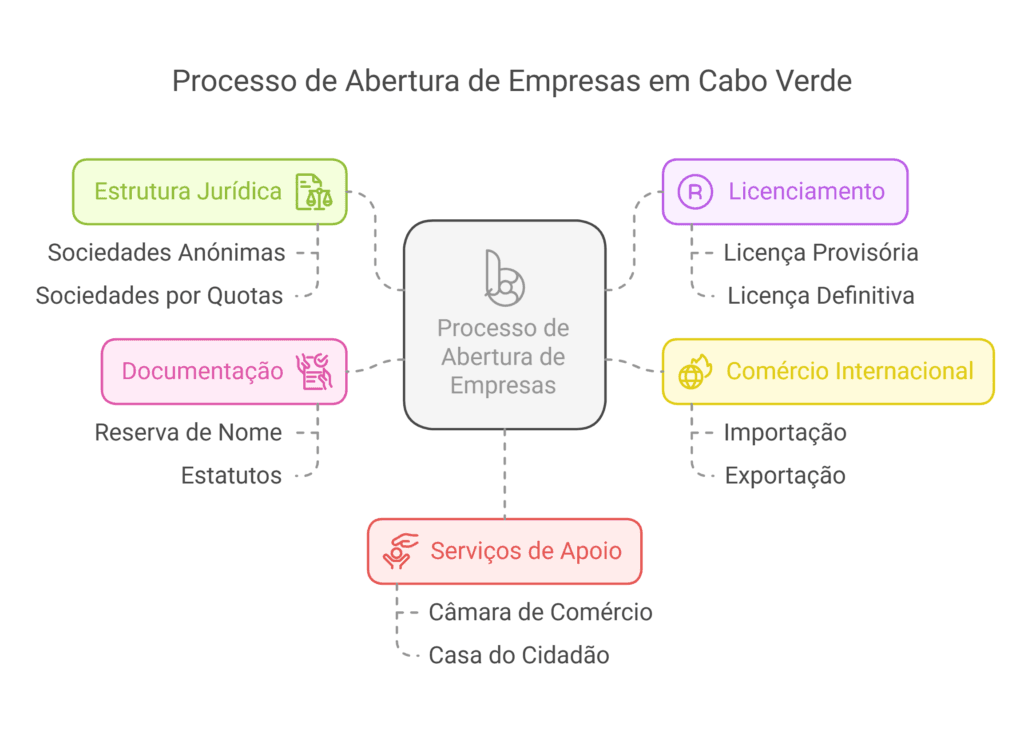

The first step in the process of starting a business in Cape Verde is choosing the appropriate legal structure. The most common options include Public Limited Companies (SA) and Private Limited Companies (Lda). The choice of legal structure influences the liability of the partners, the form of management and tax obligations. Once the choice has been made, the company must be registered with the relevant government bodies, such as the Notary's Office and the Citizen's Bureau. The "Company on the Day" service facilitates this process, allowing companies to be set up immediately (INCV).

In order to operate legally, companies in Cape Verde must obtain the appropriate licence. The licensing process varies depending on the sector of activity. For example, industrial licensing requires compliance with specific requirements, including obtaining a provisional licence, carrying out inspections and obtaining a definitive licence. This process is detailed in Industrial Licensing and Registrationwhich lists the necessary documentation for the applicant, company, manager and establishment.

Companies wishing to engage in wholesale trade, import or export must be legally incorporated and their corporate purpose must include these activities. The Barlavento Chamber of Commerce offers assistance in the licensing process for import and wholesale distribution, providing a list of required documents and associated procedures (Windward Chamber of Commerce).

The documentation required to incorporate a company in Cape Verde includes reserving the company's name, drawing up the articles of association and registering with the government. The articles of association must detail the company's objectives, the management structure and the rights and responsibilities of the shareholders. It is advisable to consult a local legal expert to ensure compliance with the Cape Verdean legal framework (Generis Online).

Cape Verde offers various support services for entrepreneurs, such as the Casa do Empreendedor (Entrepreneur's House), which centralises various business services, including issuing NIFs, registration certificates and setting up companies on the day. These services aim to simplify the process of starting a business and promote entrepreneurship in the country (Pro Company).

This report provides a detailed overview of the process of starting a business in Cape Verde, highlighting the importance of choosing a legal structure, complying with licensing requirements and accessing entrepreneurial support services. Each stage is crucial to ensuring legal compliance and the operational success of new companies in the archipelago.

Business licensing in Cape Verde is an essential process for legalising any commercial activity, ensuring that companies operate within the established rules and regulations. The documentation required varies according to the type of business and the sector of activity, but there are general requirements that all companies must fulfil.

Although there are general requirements, each sector of activity may require specific additional documentation. Below are some examples of the documentation required for common sectors:

For retail trade, a licence is required, which can be obtained through the counters of the Casa do Cidadão or the Praia Town Hall. This process can be simplified, allowing licences to be issued in up to 48 hours, in accordance with Decree-Law 30/2009 (Government of Cape Verde).

Companies wishing to engage in wholesale trade, import or export must be legally incorporated and their corporate purpose must include these activities. The Barlavento Chamber of Commerce offers assistance in the licensing process for import and wholesale distribution, providing a list of required documents and associated procedures (Windward Chamber of Commerce).

In addition to the basic documentation, there are additional procedures that may be required depending on the type of licence:

Compliance with regulatory standards is crucial to ensuring that companies operate effectively and legally. Regulations not only guarantee safety and compliance, but also have a direct impact on the country's business environment and economic development. Making these services available electronically has facilitated the process, making it more accessible and efficient for entrepreneurs (Government of Cape Verde).

To help entrepreneurs in the licensing process, various organisations offer support and resources:

Compliance with legal and regulatory requirements not only guarantees the legitimacy of companies, but also contributes to a robust and growing business environment.Special Regime for Micro and Small Enterprises (REMPE)

The Special Regime for Micro and Small Enterprises (REMPE) in Cape Verde was established to promote the formalisation, competitiveness and development of micro and small enterprises (MSEs). This regime comes in the context of significant tax reforms, aimed at creating a more favourable business environment and establishing mechanisms to support the growth of these companies (Windward Chamber of Commerce).

REMPE is a legal instrument that seeks to facilitate self-employment and the formalisation of businesses, offering economic, financial and social advantages. Its implementation requires changes in the management systems of the entities involved in the licensing process, as well as concerted efforts between these entities (Windward Chamber of Commerce).

According to Law 70/VIII/2014, a microenterprise in Cape Verde is defined as one that employs up to five workers or has an annual gross turnover of no more than 5,000,000 Cape Verdean escudos. Small businesses are those that employ between five and ten workers and have a turnover of between 5,000,000 and 10,000,000 escudos (CGC Cape Verde).

This special legal regime aims to promote the competitiveness and productivity of MSEs, encouraging formalisation and business development. Companies that fit the REMPE criteria can opt for this regime or the organised accounting regime, depending on their needs and strategic objectives (CGC Cape Verde).

Since its implementation, REMPE has played a crucial role in formalising businesses in Cape Verde. The number of people insured with REMPE has increased from 330 in 2015 to over 25,000 in 2023, with a significant participation of women (12,407 insured). This growth represents around 51.1% of the increase in those insured by the National Social Security Institute (INPS) during this period (Island Express).

The formalisation of MSEs through REMPE not only broadens the tax base, contributing to tax justice, but also boosts the growth of social security in the country. This process is fundamental to the modernisation of Cape Verde's tax system, allowing for a more transparent and efficient business environment (Island Express).

The implementation of REMPE faces significant challenges, especially with regard to the changes needed in the management systems of the organisations involved in the licensing process. These changes are often complex and require a concerted effort from all parties involved. To mitigate these challenges, the creation of an ad-hoc committee has been proposed, which serves as a platform for identifying and resolving obstacles that hinder the relationship between entrepreneurs and the national tax system (Windward Chamber of Commerce).

This collaborative approach between public entities, such as the Agency for Business Development and Innovation (ADEI), Tax Offices, INPS, Casa do Cidadão and Customs, is essential to ensure that REMPE is effective in facilitating business licensing and promoting the growth of MSEs (Windward Chamber of Commerce).

REMPE offers several benefits and incentives for micro and small businesses, including access to a special unified tax (TEU), which simplifies the tax process and reduces the tax burden on these companies. This tax is calculated on the basis of company income, providing a more predictable and accessible tax structure for MSEs (CGC Cape Verde).

In addition, REMPE aims to improve the business environment in Cape Verde by offering practical resources and refresher courses for entrepreneurs and their employees. These resources are essential for maximising the technical and economic advantages provided by REMPE's legal framework, allowing MSEs to adapt to changes in the tax system and make the most of the incentives available (Windward Chamber of Commerce).

REMPE remains a central element in Cape Verde's economic development strategy, with the potential to further boost the formalisation and growth of MSEs. The continued modernisation of the tax system and the implementation of supportive public policies are crucial to ensure that REMPE continues to offer significant benefits for companies and the economy in general.

Focusing on the sustainable development of MSEs, through tax incentives and support for formalisation, is essential to creating a resilient and dynamic business environment in Cape Verde. Collaboration between the government, public entities and the private sector will be key to overcoming the challenges and maximising REMPE's positive impact on economic growth and social justice in the country (Pro Company).

The report on business licensing in Cape Verde offers a comprehensive overview of the process of opening and legalising companies in the country, highlighting the importance of choosing a legal structure, complying with licensing requirements and using entrepreneur support services. The choice between Public Limited Companies (SA) and Limited Liability Companies (Lda) is crucial, as it influences the liability of shareholders and tax obligations. The "Company on the Day" service facilitates the incorporation of companies, while industrial and commercial licensing requires compliance with specific requirements, such as obtaining provisional and definitive licences. The documentation required for licensing is a critical component in ensuring legal compliance and the operational success of companies, with the Casa do Cidadão and the Barlavento Chamber of Commerce playing central roles in supporting entrepreneurs (INCV, Windward Chamber of Commerce).

The Special Regime for Micro and Small Enterprises (REMPE) has emerged as a vital instrument for the formalisation and growth of MSEs in Cape Verde. Since its implementation, REMPE has promoted competitiveness and the formalisation of businesses, significantly increasing the number of people insured with the National Social Security Institute (INPS). This scheme offers tax benefits and incentives that simplify the tax process, contributing to a more transparent and efficient business environment. However, the implementation of REMPE faces challenges, such as the need for changes in the management systems of the entities involved in licensing. Collaboration between public and private entities is essential to overcome these challenges and maximise REMPE's positive impact on economic growth and social justice in the country (Island Express, Windward Chamber of Commerce).

The future prospects for the sustainable development of MSEs in Cape Verde are promising, with REMPE playing a central role in the country's economic strategy. The continued modernisation of the tax system and the implementation of supportive public policies are crucial to ensure that REMPE continues to offer significant benefits. Collaboration between the government, public entities and the private sector will be key to maximising REMPE's positive impact on economic growth and social justice, creating a resilient and dynamic business environment in Cape Verde (Pro Company).