In Cape Verde's current economic context, the tax framework plays a crucial role in the development and sustainability of businesses. This report aims to provide a comprehensive and detailed overview of the process of establishing companies in Cape Verde, highlighting the tax and legal aspects that entrepreneurs should consider.

Cape Verde has established itself as an attractive investment destination thanks to its strategic geographical location, political stability and commitment to sustainable development. The Cape Verdean government has implemented favourable tax policies to encourage entrepreneurship and attract foreign investment, especially from the Cape Verdean diaspora. For more information on the incentive policies, see the official website of the Government of Cape Verde.

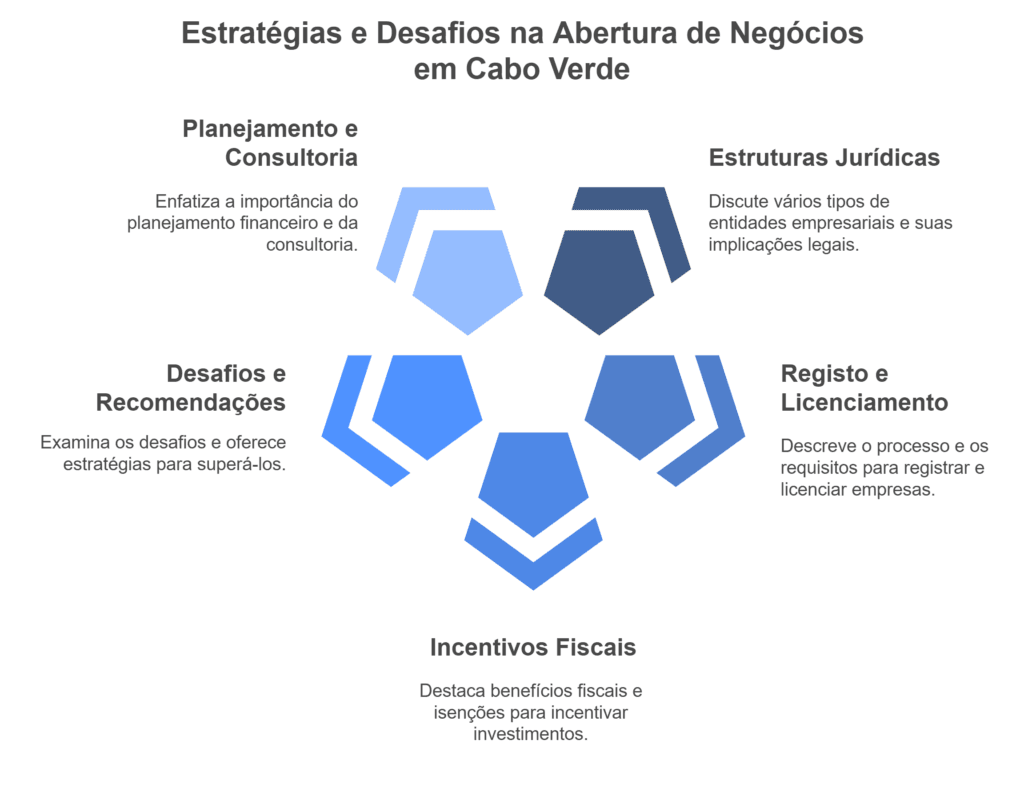

Starting a business in Cape Verde can be done using two main methods: registering with a notary or using the "Company on the Day" service. The latter, created by Decree-Law 9/2008, aims to simplify and speed up the company formation process. However, online company formation is not yet in operation in the country.

In addition, the tax framework in Cape Verde offers a variety of incentives, including tax exemptions and reductions, especially in strategic sectors such as tourism, renewable energies and information technology. These incentives are part of a wider effort to foster sustainable economic development and increase the country's competitiveness on the international stage. For a detailed analysis of the tax incentives available, see the report by S&D Consultancy Cape Verde.

This report is designed to equip entrepreneurs with the knowledge they need to navigate Cape Verde's complex tax landscape, ensuring that their operations comply with local regulations and maximise the tax benefits available to them.

Contents

In Cape Verde, choosing a legal structure is one of the first critical steps in starting a business. The most common forms of commercial companies include general partnerships, private limited companies, public limited companies, limited partnerships and co-operative companies. Each type of company has specific characteristics that influence the liability of the partners, the management and taxation of the company (Windward Chamber of Commerce).

Private limited companies are one of the most popular forms of company for small and medium-sized businesses in Cape Verde. This type of company limits the liability of the partners to the amount of the subscribed share capital, which offers significant protection for the partners' personal assets. In addition, management is generally simpler, making it ideal for small or family businesses.

Public limited companies are more suitable for larger companies that want to raise capital by issuing shares. This type of company allows for greater flexibility in the transfer of shares and can facilitate access to external financing. However, reporting and auditing requirements are stricter, which can increase administrative costs.

Registering a company in Cape Verde involves several steps, starting with obtaining a Tax Identification Number (NIF) and registering with the Commercial Registry. This process requires the presentation of documents such as the memorandum and articles of association, certificates of qualifications and criminal record and, in some cases, powers of attorney (Vision Contact).

Depending on the sector you operate in, you may need specific licences to operate legally. For example, companies that have an impact on the environment, such as those in the industrial or construction sector, need environmental licences. In addition, sectors such as health and education require specific licences to ensure compliance with local regulations (S&D Consultancy).

Cape Verde offers various tax incentives to attract investment and stimulate economic development. The Tax Incentives Code covers benefits such as exemptions from Value Added Tax (VAT), Stamp Duty, and Single Income Tax (IUR). In addition, the Special Unified Tax and Social Security Contributions Regime offers a special unified tax of 4% on the gross value of sales for micro and small businesses, replacing other taxes such as VAT and the Fire Tax (AMMOURA Associates).

Companies that import goods transport vehicles that are no more than five years old can benefit from exemptions from customs duties and VAT, as long as the vehicle is used exclusively for commercial activities. This benefit is particularly attractive for logistics and transport companies, significantly reducing initial operating costs.

Despite the opportunities, entrepreneurs in Cape Verde face challenges such as limited access to finance and bureaucracy. To mitigate these obstacles, the creation of innovative financing mechanisms such as venture capital funds and crowdfunding platforms is recommended. In addition, simplifying regulatory and administrative processes can facilitate the creation and operation of companies, making the business environment more favourable (S&D Consultancy).

Strengthening partnerships between the government, the private sector and international organisations is crucial for developing infrastructure and training entrepreneurs. These partnerships can provide access to resources and knowledge that are essential for business success in Cape Verde.

Financial planning and consultation with experienced professionals are crucial steps to ensure compliance and efficiency in the process of starting a business. Conducting detailed market research can provide valuable insights into business viability and local competition, allowing entrepreneurs to focus on the growth and success of their business.

Working with legal and accounting advisors can help navigate the legal and tax complexities of registering a company. These professionals can offer guidance on best practices to optimise the tax structure and ensure that all legal obligations are met effectively.

Starting a business in Cape Verde requires a thorough understanding of the legal, fiscal and administrative procedures. With the right tax incentives and the support of experienced consultants, entrepreneurs can take advantage of emerging opportunities in the Cape Verdean market, especially in sectors such as technology, sustainable tourism and renewable energies.

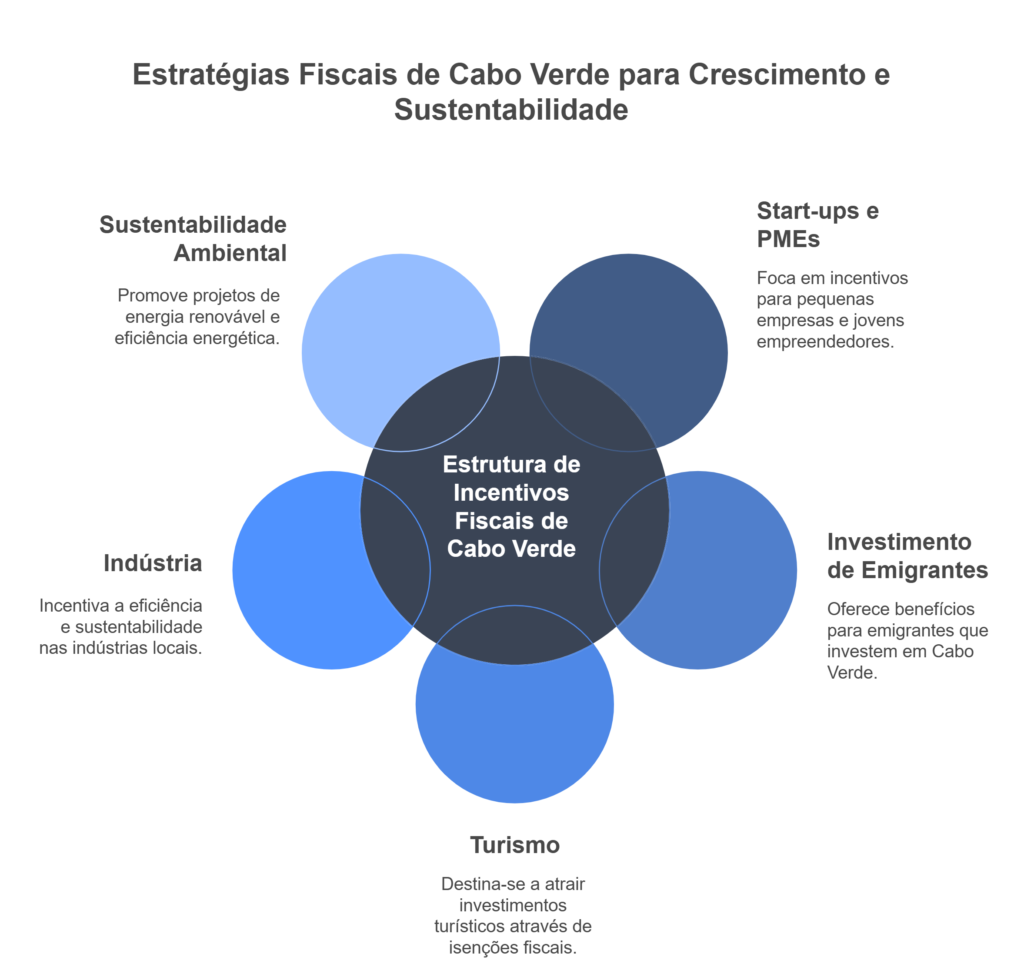

In Cape Verde, the government has implemented a series of tax incentives to encourage entrepreneurship, especially among start-ups and small businesses. These incentives are crucial for stimulating innovation and economic growth. One notable example is the StartUp Jovem programme, which aims to promote entrepreneurship among young people aged between 18 and 35. This programme offers significant tax benefits for new or embryonic companies that develop innovative business ideas, regardless of whether they are technology-based (Pro Company).

The Cape Verdean government has also introduced specific tax incentives for emigrants who make direct investments in the country. Law 73/IX/2020, of 2 March, establishes a tax incentive scheme for emigrants, including exemption from IRPC taxation on dividends and distributed profits, as well as exemption from customs duties on the purchase of materials for building or refurbishing housing (Consular Portal). This initiative aims to attract foreign capital and foster local economic development.

The tourism sector in Cape Verde benefits from a specific tax regime aimed at attracting investment and promoting the development of this strategic sector. Decree-Law 22/2020 establishes the Tourist Utility status regime, which grants tax benefits to projects that contribute to sustainable tourism development. These benefits include tax exemptions on the import of construction materials and equipment needed to implement tourism projects (Carla Monteiro & Associados).

To boost the industrial sector, Cape Verde has implemented Legislative Decree 13/2010, which defines the country's industrial policy objectives. This decree grants tax incentives for the purchase of equipment and technologies that promote energy efficiency and environmental sustainability. The policy aims not only to increase the competitiveness of local industries, but also to align itself with the Sustainable Development Goals (Carla Monteiro & Associados).

The Special Unified Tax and Social Security Contribution Scheme offers a unified tax of 4% on the gross value of sales for micro and small businesses, replacing other taxes such as VAT and Fire Tax. This scheme aims to simplify the tax system for small businesses, reducing the administrative burden and encouraging business formalisation (AMMOURA Associates).

Legislative Decree no. 11/2010, of 1 November, approves specific tax benefits for the construction, rehabilitation and acquisition of real estate. These benefits include VAT and Stamp Duty exemptions, as well as tax deductions for expenses related to improving housing infrastructure. This policy aims not only to stimulate the construction sector, but also to improve the living conditions of Cape Verdean citizens (Windward Chamber of Commerce).

The 2025 State Budget includes tax incentives for the transport sector, with the aim of improving Cape Verde's internal and external connectivity. These incentives include subsidies for discounts on inter-island travel tickets and support for the creation of public companies such as Linhas de Cabo Verde, which aim to improve national air links (Have).

The Cape Verdean government also prioritises investments in health and education infrastructure, offering tax incentives for projects aimed at improving these sectors. These incentives include tax deductions for investments in equipment and technologies that improve the quality of the services provided. This policy is in line with the aim of promoting the country's economic and social resilience (Ministry of Finance).

To promote environmental sustainability, Cape Verde offers tax incentives for projects aimed at utilising renewable energies and energy efficiency. These incentives include tax exemptions on the import of solar and wind equipment, as well as tax deductions for investments in green technologies. This policy is in line with the country's commitments to the Sustainable Development Goals (Ministry of Finance).

The Cape Verdean government implements tax policies that promote social and territorial cohesion, incentivising investments that contribute to balanced development between the islands. These incentives include tax breaks for projects that create jobs and promote social inclusion, especially in rural and less developed areas. This approach aims to transform each island into its own economy, aligned with its respective vocations (Ministry of Finance).

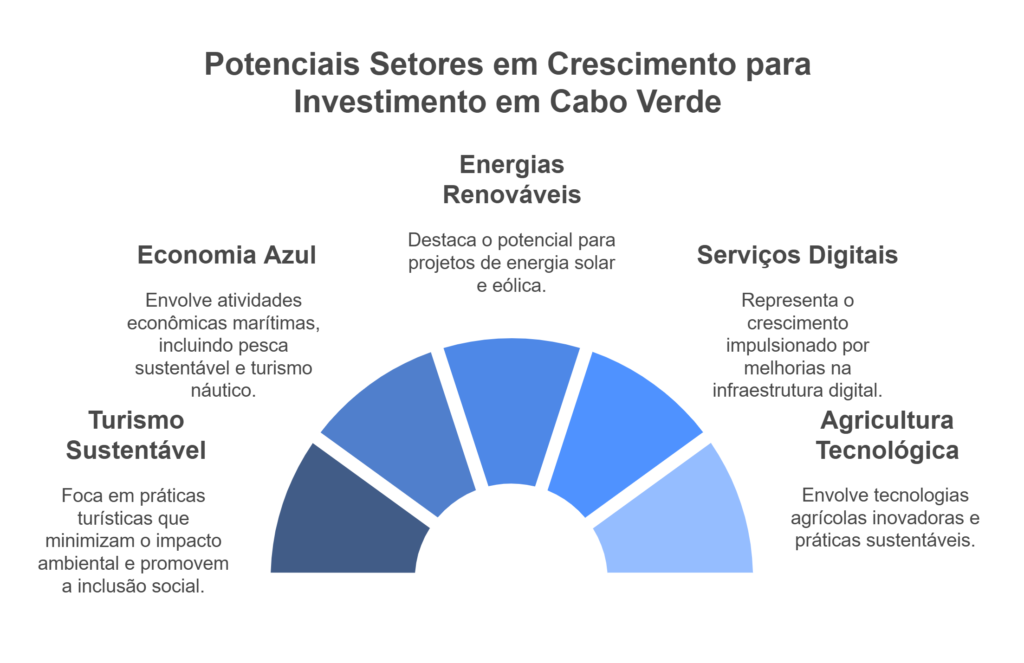

Sustainable tourism in Cape Verde has emerged as one of the most promising sectors for investment, with a growing focus on practices that minimise environmental impact and promote social inclusion. The country attracts tourists with its paradisiacal beaches, tropical climate and rich culture, accounting for around 25% of the national GDP (S&D Consultancy). In 2023, Cape Verde received approximately 800,000 tourists, an increase of 10% on the previous year. The government has encouraged investment in tourism infrastructure, including hotels, resorts and associated services, to meet the growing demand.

The blue economy, which covers economic activities related to the sea, is another sector with great growth potential in Cape Verde. The archipelago, with its vast maritime zone, offers opportunities in areas such as sustainable fishing, aquaculture and nautical tourism. The World Bank report emphasises the importance of diversifying the country's tourism offer towards higher value-added niches, such as nautical and cultural tourism (World Bank).

Cape Verde has significant potential for the development of renewable energies, especially solar and wind power. The government has set ambitious targets to achieve 50% of renewable energy in the energy mix by 2030 (Government of Cape Verde). This commitment opens up investment opportunities in energy infrastructure, such as solar and wind farms, as well as innovative technologies for energy storage and distribution.

The digital services sector is expanding rapidly in Cape Verde, driven by investments in digital infrastructure and capacity-building initiatives. Digital connectivity has advanced, with an increase in internet penetration, which will reach 65% of the population by 2023 (ITU). This growth offers opportunities for information and communication technology (ICT) companies and innovative start-ups looking to exploit the Cape Verdean market.

Technological and sustainable agriculture is an emerging sector in Cape Verde, with opportunities for investors interested in innovative agricultural technologies and resilient cultivation practices. This sector can benefit from investments in technologies that increase agricultural efficiency and productivity, while promoting sustainable practices that preserve the country's natural resources (S&D Consultancy).

While the previous sections covered topics such as "Procedures for Starting a Business" and "Tax Incentives", this report focuses specifically on identifying promising sectors for investment in Cape Verde. The analysis presented here complements the existing content by exploring in detail the specific opportunities and challenges of each sector, without overlapping with the information previously discussed.

Despite the opportunities, investors should be aware of the challenges that can affect the private sector in Cape Verde, such as energy, transport and connectivity issues. Risk mitigation strategies, such as local partnerships and the adoption of sustainable practices, are essential to maximise the return on investment and contribute to the country's sustainable development (World Bank).

The Cape Verdean government offers fiscal and regulatory incentives, such as tax exemptions and the creation of special economic zones, to attract foreign investment (Government of Cape Verde). These incentives are designed to improve the business environment and facilitate investment in strategic sectors, contributing to the country's sustainable economic growth.

With a stable political environment and favourable economic policies, Cape Verde is well placed to attract investment in strategic sectors. The ability to overcome existing economic challenges, such as economic diversification and reducing public debt, will be crucial to ensuring sustainable and inclusive growth by 2025. The analysis presented offers a comprehensive and strategic vision for investors wishing to participate in Cape Verde's economic growth (S&D Consultancy).

The report on the fiscal framework for business in Cape Verde emphasises the importance of understanding the legal, fiscal and administrative procedures for starting a business in the country. Choosing the right legal structure, such as private limited companies or public limited companies, is crucial for determining the responsibility of shareholders and business management. The registration and licensing process, although bureaucratic, is facilitated by significant tax incentives offered by the Cape Verdean government, which aim to attract investment and stimulate economic development. These incentives include exemptions from VAT, Stamp Duty and Single Income Tax, as well as special regimes for micro and small businesses, such as the Special Unified Tax Regime (AMMOURA Associates).

Promising sectors for investment, such as sustainable tourism, the blue economy, renewable energies and digital services, present significant opportunities for investors. The government has implemented fiscal and regulatory policies to foster growth in these sectors, in line with the Sustainable Development Goals. However, challenges such as access to finance and bureaucratic complexity persist, requiring mitigation strategies such as public-private partnerships and the simplification of regulatory processes (World Bank). Political stability and favourable economic policies position Cape Verde as an attractive investment destination, with the potential for sustainable and inclusive economic growth by 2025.